The difference between someone owning and renting is simple, it’s in the preparation.

I’m sure you know someone who tried buying a home but was not able to qualify. They usually go on another 3-5 year renting phase because, well, life happens. The worst part is, they will probably try to buy a home again… but fail.

Alternatively, you probably know someone who purchased a home and thought to yourself, “How the hell did they do that?” Well I’ve got the answer for you, they prepared.

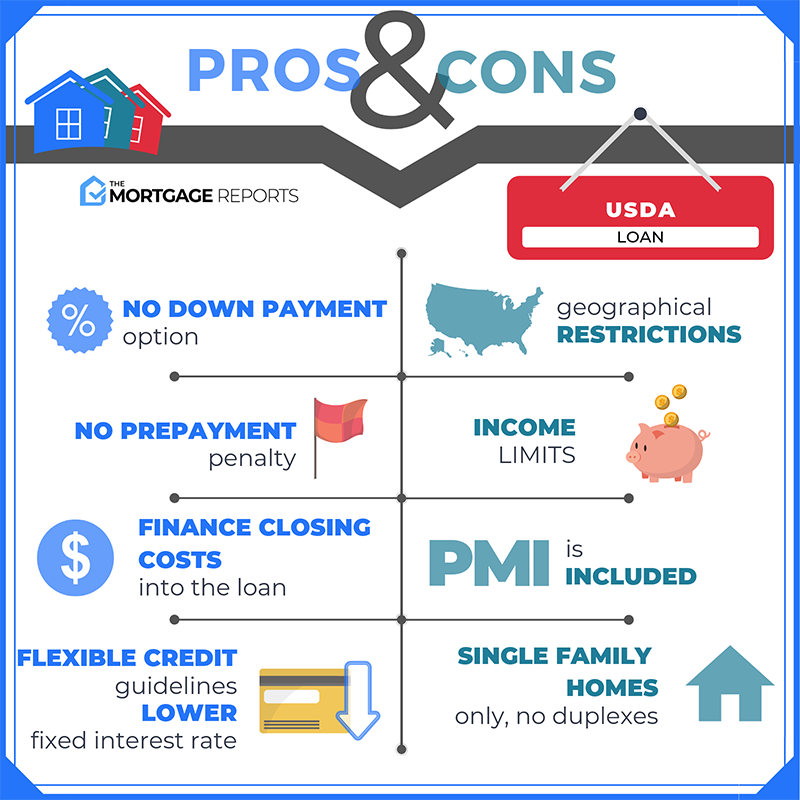

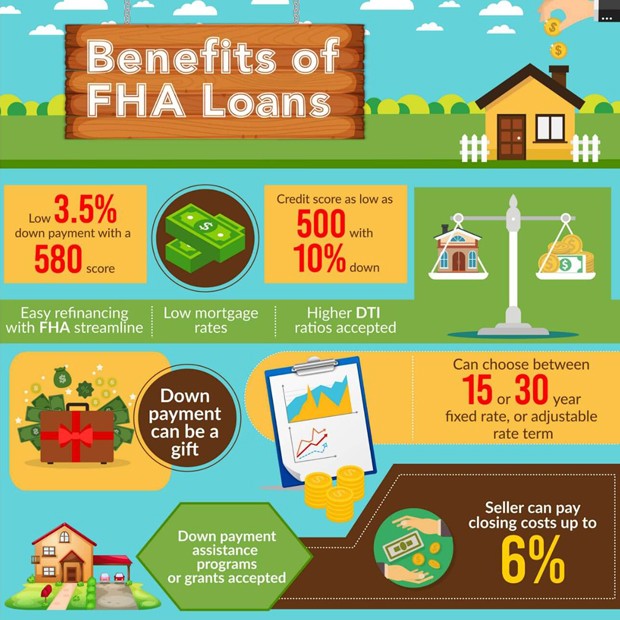

The interesting thing about homeownership is that no matter your circumstances, there is likely a program for you. Education and preparation become the key. The person that purchased, regardless of their circumstances, met with a professional who gave them a step by plan to home ownership.

The Market Today

The market today is fueled by low mortgage rates as well as job and wage growth. These factors have been driving demand and enticing new players to get into the market. Millennials and first time home buyers are looking to get in on the action.

However, most are finding that the road to homeownership can be complicated and requires being financially prepared. If there is anything you take away from this article it should be this.

The worst thing that can happen to a motivated buyer is rejection. Flat out rejection, without any explanation, will turn a motived homebuyer into a lifelong renter.

Here are my tips for first time homebuyers:

- Monitor your credit score! Please pay your debts on time. Most banks look for a minimum 620 FICO score.

- Keep your debts low. High credit card debt and student loans will hold you back from being able to buy something you like (debt to income ratio).

- Have open lines of credit! You do not want to be a credit ghost. I recommend having at least 2-3 lines of credit open for at least 6 months before purchasing.

- Plan accordingly for purchase costs. Down payment and closing costs are usually the most difficult money for first time homebuyers to get together.

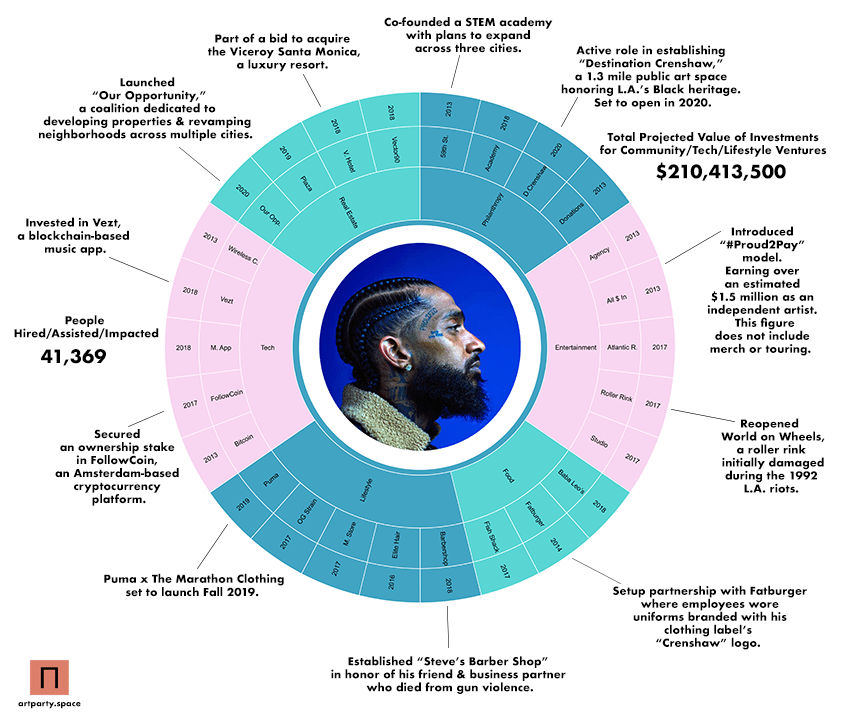

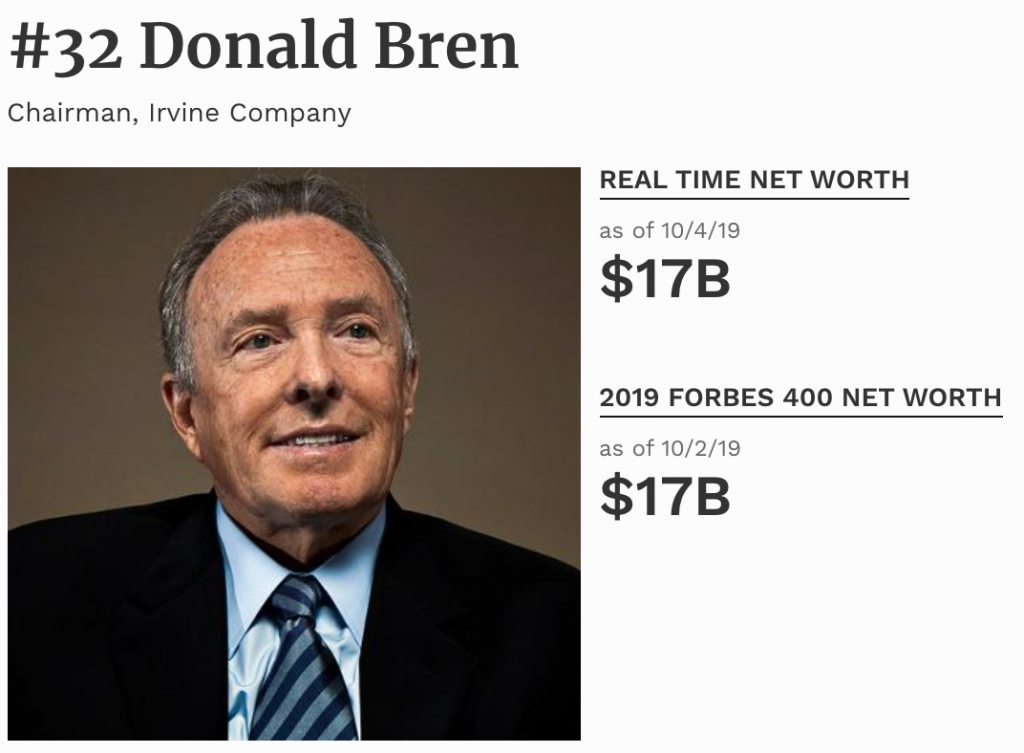

- Have a ‘bigger picture’ mentality. Know that your first home will not be your last and that it has the potential of making you lots of money.

- Find out how much house you can afford! Speak to a professional to get an idea of where you are financially and what that means for your purchasing power.

As mentioned earlier, homeownership begins with preparation. Finding out how much house you can afford starts with looking at your finances and talking with a professional. Once you’ve figured out a price point that suits your budget, you can begin to get the tips mentioned above in order to ensure a smooth home buying experience.

Educating yourself about program requirements and taking the time to find the right home are absolute musts. Again, do not try this alone! You don’t want to be a lifelong renter that never owns an asset that has the potential to change your life. Your success depends on your ability to prepare. Benjamin Franklin said it best, “By failing to prepare, you are preparing to fail.”

Interested in homeownership? Let’s prepare! For more information please visit kendellangeles.com or hit me up in the comments below.

Thank you for reading this article! If you found this information helpful please like, comment, and share. See you next time.

Keep Going,

Kendell Angeles