Rent = Melting Money

If you are like most people I talk to on a daily basis, then you believe you need 20% down to purchase your dream home. NOTHING could be further from the truth! If this information is holding you back from owning a home, then please continue reading this article and I will tell you exactly how to get your home with very little money down.

In this article, I will be highlighting some of my favorite real estate billionaires. I’ll point out some of their most impressive real estate holdings. In a later article I will point out why these people decide to invest in such incredible properties. Let’s get started!

Buy a home as a primary residence.

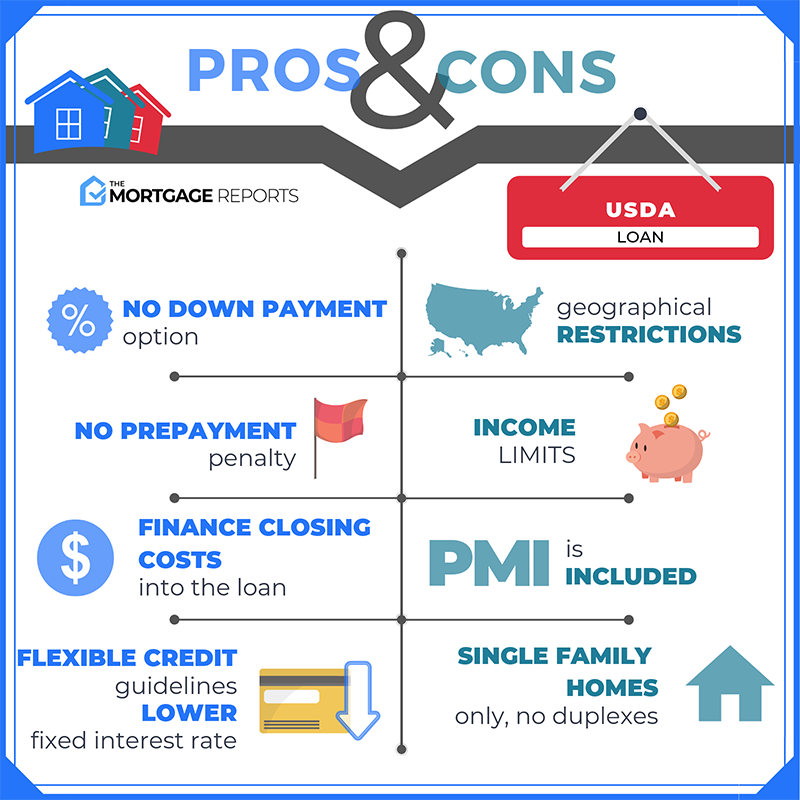

VA & USDA Loans

You can purchase a home to live in with zero down, using VA and USDA financing programs. If you’re a Veteran then you’ve probably heard about VA home loans. This mortgage program is the greatest benefit provided to our Nation’s Veterans. These loans are not just for first-time buyers, veterans can use a VA home loan multiple times throughout their life-time.

USDA loans are available to home buyers with low-to-average income for their area. They also offer 100% financing with reduced mortgage insurance premiums, and feature below-market mortgage rates. USDA home loans are putting people in homes who never thought they could do anything but rent.

The down payment and credit score requirements for a primary residence are less stringent than conventional financing options. Although I do recommend having some money in reserve at all times, it is definitely possible to get started without much money in savings.

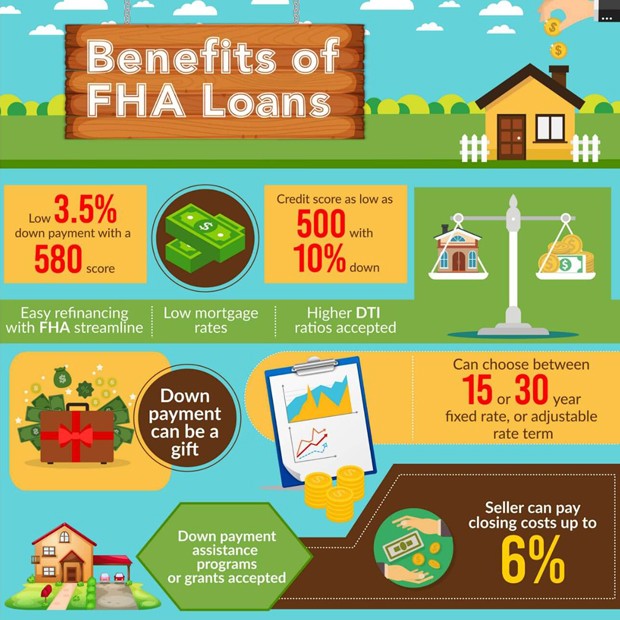

FHA Loans

FHA stands for the Federal Housing Administration, which is a government agency. This loan was designed to allow more first-time home buyers to qualify for home loans by allowing for lower credit scores and lower down payment requirements.

FHA loans only require 3.5 percent down payment! Many conventional programs require down payments ranging from 5 percent to as high as 20 percent.

For example, if you are purchasing a $200,000 home, a conventional loan will require 5 percent down, or $10,000. With an FHA loan, at 3.5 percent down, the down payment would be $7,000 for a $200,000 home.

Everybody has different circumstances and goals!

Each home buyer has a unique set of circumstances and goals that will impact the type of loan that works best for them. Please make sure you work with a professional lender that spends the time to educate you so you are able to choose the best loan for your situation.

If you found this information helpful please like and comment below. For more information on all loan products mentioned here please visit kendellangeles.com and apply for a mortgage loan today.

Keep going,

Kendell Angeles